are my assisted living expenses tax deductible

Most of the time assisted living costs are tax-deductible. Browse Get Results Instantly.

Are Medical Expenses Tax Deductible

According to the IRS any qualifying.

. To return to Moms and Dads situation above they have 48600 of medical expenses the assisted living facility costs and the unreimbursed drug. If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction. According to the 1996 Health Insurance Portability and Accountability Act HIPAA long-term care services may be tax deductible as an unreimbursed medical expense on Schedule A.

See the following from IRS Publication 502. If you your spouse or your dependent is in a nursing home primarily for medical. According to the IRS any qualifying.

Yes in certain instances nursing home expenses are deductible medical expenses. Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. The medical deduction for assisted living includes all the expenses if the primary reason for living in a facility is for medical care.

Deductible Assisted Living Facility Costs. The medical expense tax deduction may be available to you or your loved one if they live in an assisted living community. The Deductibility of Medical Expenses Section 213 of the.

In order for assisted living. If you are paying for a loved ones assisted living costs they are quite likely considered chronically ill. Many expenses are tax-deductible and in many cases some or all of your assisted living costs may also get you a tax break.

As long as the resident meets the IRS qualifications see above all assisted living expenses including non-medical costs like housing and meals are tax deductible. Not all assisted living costs can be deducted but if you or your loved one calls an assisted living community home you may be able to deduct some service expenses or fees. We have put together some guidelines that will help seniors or.

Ad Search For Info About Are assisted living expenses tax deductible. In order for assisted living. With the median cost for an assisted living facility close to 50000 and over 100000 for nursing home care it would be helpful to find a way to reduce the financial burden.

Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. SmartAnswersOnline Can Help You Find Multiples Results Within Seconds. December 28 2021.

Simply add up the. If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction. Depending upon Moms condition and with a bit of planning the assisted living facility costs might be tax deductible.

Yes if you live in an assisted living facility you can generally write off a number of medical expenses included in the fees for assisted living as well as other qualified long-term care. Assisted living expenses may also be deductible if an individual requires supervision due to a cognitive impairment such as Alzheimers or another form of dementia.

Are Medical Expenses Tax Deductible Community Tax

10 Creative But Legal Tax Deductions Howstuffworks

Amazon Echo Offer Caregivers And Patients Freedom And Independence Voice Activated Technology To Assist Daily Living Activities Amazon Echo Echo Caregiver

Are Medical Expenses Tax Deductible Community Tax

Are Long Term Care Costs Tax Deductible In Canada Ictsd Org

Common Health Medical Tax Deductions For Seniors In 2022

Which Dental Expenses Are Considered Deductible Medical Expenses When Filing Income Taxes 2022 Turbotax Canada Tips

Tax Deductible Expenses For Photographers Freelance Tax Tax Deductions Photographer Tax

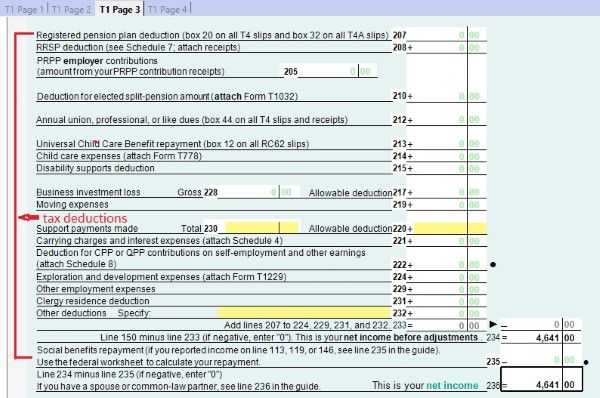

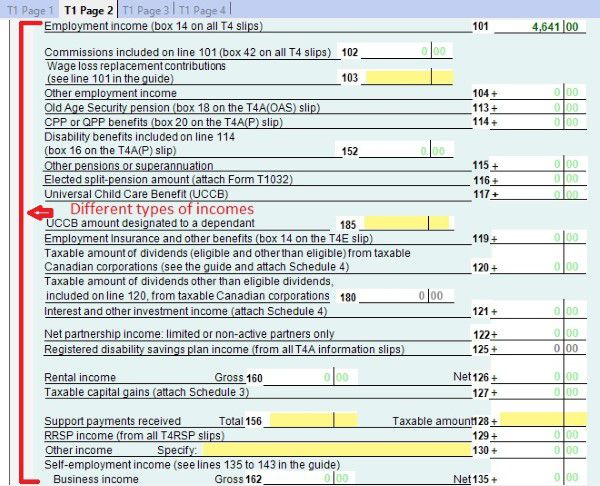

Tax Course 8 Understand Individual Income Tax Return

What Tax Deductions Are Available For Assisted Living Expenses

Common Health Medical Tax Deductions For Seniors In 2022

How To Deduct Your Home Office On Your Taxes Forbes Advisor

Private Home Care Services May Be Tax Deductible

Claiming Your Dependant S Medical Expenses H R Block Canada

Tax Course 8 Understand Individual Income Tax Return Solid Tax

Truck Driver Expense Spreadsheet Laobing Kaisuo Truck Driver Spreadsheet Drivers

Itemized Deductions Medical Dental Expenses 550 Income Tax 2020 Youtube

Why You May Still Owe The Doctor Even After Paying Your Copayment Medical Debt Medical Billing Medical Billing And Coding